Understanding the Risks of Investing in Cryptocurrency:

A Comprehensive Guide (2024)

Cryptocurrency: The Wild West of Investing

In this blog, we shall be understanding-the-risks-in-cryptocurrency, as well as strategies for mitigating those risks.

Cryptocurrency has taken the world by storm, with its decentralized and secure nature attracting investors from all walks of life. Investing in cryptocurrency can be a thrilling ride. It's like the Wild West of investing, full of risk and reward, and constantly evolving. However, before you jump into the world of crypto, it's important to understanding-the-risks-in-cryptocurrency.

Cryptocurrency refers to a digital or virtual currency that uses cryptography for security and operates independently of a central bank. It relies on blockchain technology, which allows for a secure, transparent, and decentralized ledger of transactions. Cryptocurrencies can be used for online purchases, investments, and as a means of payment.

Brief History of Cryptocurrency :

The first cryptocurrency, Bitcoin, was introduced in 2009 by an anonymous person or group known as Satoshi Nakamoto. Bitcoin was designed to be a decentralized digital currency that could operate without the need for intermediaries like banks or governments.

In the years following Bitcoin's launch, many other cryptocurrencies were developed, including Ethereum, Ripple, and Litecoin. These currencies offered different features and use cases, such as smart contract functionality and faster transaction speeds.

Cryptocurrencies gained popularity as an alternative to traditional financial systems, as they allowed for greater privacy, security, and freedom from government control. However, their use in illegal activities and lack of regulation led to skepticism and caution from many financial institutions and governments.

Despite this, the cryptocurrency market continued to grow, with Bitcoin reaching an all-time high of nearly $65,000 in 2021. Today, cryptocurrencies are widely used for investment and speculation, as well as for online purchases and transactions. Many industries are also exploring the use of blockchain technology for various applications beyond currency.

Popular Types of Cryptocurrency:

Cryptocurrencies have become increasingly popular in recent years, with thousands of different digital currencies in existence. Here are some of the most popular and well-known types of cryptocurrency:-

Bitcoin (BTC)

Launched in 2009, Bitcoin was the first decentralized cryptocurrency and remains the most well-known. It uses a proof-of-work consensus mechanism to validate transactions and has a finite supply of 21 million coins.

Ethereum (ETH)

Developed in 2015, Ethereum is a decentralized blockchain platform that allows for the creation of smart contracts and decentralized applications (dApps). It uses a proof-of-stake consensus mechanism and has a native currency called Ether (ETH).

Binance Coin (BNB)

Binance Coin is the native token of the Binance exchange, which is one of the largest cryptocurrency exchanges in the world. It is used to pay for trading fees on the exchange and can also be used to access other features.

Dogecoin (DOGE)

Created in 2013 as a joke cryptocurrency, Dogecoin gained popularity in 2021 due to endorsements from celebrities like Elon Musk. It uses a proof-of-work consensus mechanism and has a meme-inspired design.

Cardano (ADA)

Launched in 2017, Cardano is a decentralized platform that aims to provide a more secure and scalable platform for dApps. It uses a proof-of-stake consensus mechanism and has a native currency called ADA.

These cryptocurrencies and others like Ripple (XRP), Litecoin (LTC), and Tether (USDT) have different features, use cases, and levels of popularity among investors and traders. While some are primarily used as a store of value or investment, others have specific use cases within their respective ecosystems.

II. Benefits of Investing in Cryptocurrency

Decentralization and Security :

Cryptocurrencies offer benefits such as decentralization and security. Decentralization means that there is no central authority controlling the currency, making it more resistant to manipulation or censorship. Security is provided through cryptography and the use of a decentralized ledger, making transactions more secure and transparent.

Greater Potential for Growth:

Cryptocurrencies offer the potential for greater growth compared to traditional assets due to their high volatility and relatively low correlation with other markets. This has made them attractive to investors looking for diversification and higher returns. However, this potential for growth also comes with higher risk.

Accessibility and Ease of Use:

Cryptocurrencies offer greater accessibility and ease of use compared to traditional financial systems. Anyone with an internet connection can buy, sell, or transfer cryptocurrencies without the need for intermediaries or complex processes. Cryptocurrency wallets and exchanges also make it easy to manage and store digital assets securely.

III. Risks of Investing in Cryptocurrency : What You Need to Know?

While cryptocurrency has some unique advantages, such as borderless transactions and lower fees, it also comes with its own unique risks and challenges, such as volatility and regulatory uncertainty.

Bitcoin Volatility and Unpredictability: The Rollercoaster Ride

Bitcoin, the first and most well-known cryptocurrency, is infamous for its volatility. Its price can swing wildly from one day to the next, making it a risky investment for those who are risk-averse. For example, in 2017, Bitcoin surged from $900 in January to nearly $20,000 by December, only to crash back down to $3,000 the following year. This kind of rollercoaster ride can be exciting for some, but it's the kind of ride that can make even the most seasoned investor feel queasy.

Regulatory Risks: The Uncertain Future of Crypto

But volatility isn't the only risk associated with crypto. There's also the lack of regulation. Unlike stocks and bonds, which are governed by a complex web of rules and regulations, crypto operates in a sort of regulatory limbo. This means that investors are more vulnerable to fraud and market manipulation. Some countries have embraced cryptocurrency and even legalized it as a form of payment, while others have banned it outright. Regulatory changes can have a significant impact on the value of cryptocurrencies, making them a risky investment.

Hacking and Cybersecurity Risks: Protect Your Crypto

Because cryptocurrency transactions are irreversible and untraceable, they are an attractive target for hackers. Cryptocurrency exchanges and wallets have been hacked in the past, resulting in millions of dollars in losses. It's crucial to take extra precautions to secure your crypto, such as using strong passwords, enabling two-factor authentication, and keeping your private keys offline.

Then there's the issue of security. Crypto may be built on blockchain technology, which is generally considered to be secure, but that doesn't mean it's invincible. Hackers and other malicious actors have targeted crypto exchanges and wallets, making off with millions in stolen funds.

Cryptocurrency Scams and Frauds: Don't Get Fooled

Another major risk of investing in cryptocurrency is the prevalence of scams. With little regulation in the crypto market, it's easy for fraudsters to create fake projects and lure investors into parting with their money. Common scams include Ponzi schemes, fake initial coin offerings (ICOs), and phishing attacks. Investors must be vigilant and do their due diligence before investing in any cryptocurrency project.

IV. Mitigating Risks When Investing in Cryptocurrency

Now that we've explored some of the potential risks of investing in cryptocurrency, let's look at some tips for minimizing your risk exposure:

Cryptocurrency has gained a lot of attention and popularity in recent years. With its potential for high returns and decentralized structure, many investors are considering adding cryptocurrency to their investment portfolios. However, with the high volatility and lack of regulation in the cryptocurrency market, investing in digital assets also comes with high risks.

Now let's look at some tips for minimizing your risk exposure:-

#1. Do Your Research:

Before investing in any cryptocurrency, it is essential to do your research. Many cryptocurrencies have unique use cases and features that differentiate them from one another. Understanding these differences and evaluating each cryptocurrency's potential can help you make informed investment decisions.

Start by researching the project's whitepaper, which outlines the project's goals, vision, and roadmap. Analyze the project's technology, team, and community to determine whether it has the potential to succeed in the long term. You can also look at news articles, online forums, and social media to gauge community sentiment and get a better understanding of the project's potential.

It is also essential to stay up-to-date on any news or developments related to the cryptocurrency. Follow reputable news sources and social media accounts to stay informed about changes in the market and any potential risks or opportunities. This is an important step to understanding-the-risks-in-cryptocurrency.

#2. Diversify Your Portfolio:

Diversifying your cryptocurrency portfolio is crucial for minimizing risk. Investing in multiple cryptocurrencies with different use cases and levels of risk can help reduce the impact of any losses on your overall portfolio.

Diversification can also help you take advantage of different market conditions. For example, some cryptocurrencies may perform better during bullish market conditions, while others may perform better during bearish market conditions.

However, it is also essential to avoid over-diversification. Investing in too many cryptocurrencies can make it challenging to keep track of your investments and can also increase your exposure to risk. A good rule of thumb is to invest in no more than five to ten cryptocurrencies at a time. This is an important step to understanding-the-risks-in-cryptocurrency.

#3. Invest Only What You Can Afford To Lose

Investing in cryptocurrency is inherently risky, and you should only invest money that you can afford to lose. It is essential to evaluate your financial situation and determine how much you can afford to invest without affecting your financial stability.

It is also important to avoid investing with borrowed money, such as credit cards or loans. Investing with borrowed money can put you in a precarious financial situation if the market does not perform as expected. This is an important step to understanding-the-risks-in-cryptocurrency.

#4. Use A Secure Wallet

Storing your cryptocurrency in a secure wallet is essential for protecting your assets from hackers and other security threats. A cryptocurrency wallet is a software application that stores your private keys, which are necessary for accessing your cryptocurrency.

There are several types of wallets available, including hardware wallets, software wallets, and web wallets:

(a) Ledger Nano S -

A hardware wallet that stores private keys offline and requires a physical button press to confirm transactions. It supports a wide range of cryptocurrencies and has a user-friendly interface.

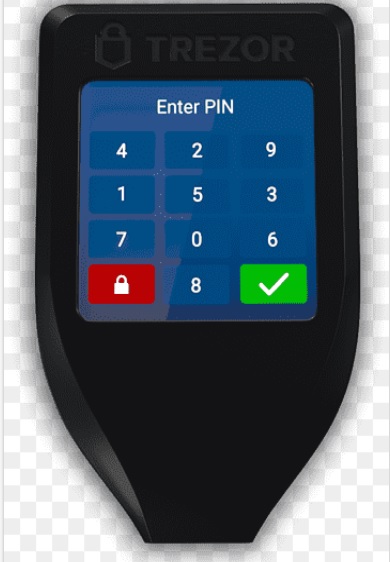

(b) Trezor

Another hardware wallet that offers similar features to the Ledger Nano S, including offline storage and two-factor authentication. It also has a password manager and a recovery seed option.

(c) Exodus

A desktop wallet that offers a clean and intuitive interface, as well as support for a wide range of cryptocurrencies. It also has built-in exchange functionality, allowing users to quickly swap between currencies.

(d) MyEtherWallet

Web-based wallet that allows users to store and manage Ethereum and ERC-20 tokens. It offers robust security features, including two-factor authentication and support for hardware wallets.

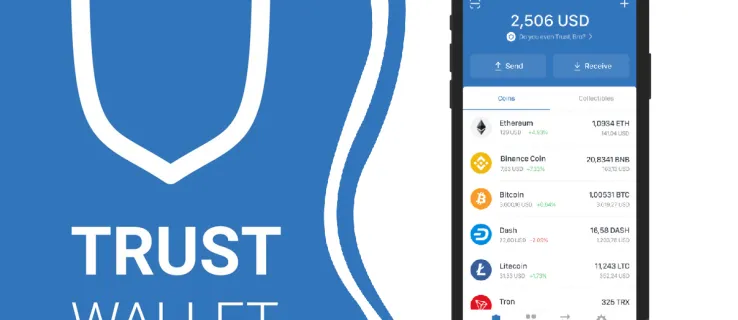

(e) Trust Wallet

A mobile wallet that supports a wide range of cryptocurrencies and provides users with complete control over their private keys. It also features a built-in DApp browser, allowing users to access decentralized applications directly from their wallet. Trust Wallet was acquired by Binance in 2018 and is now an official Binance wallet.

#5. Use Reputable Exchanges

When buying or selling cryptocurrency, it is essential to use reputable exchanges that have a track record of security and reliability. Look for exchanges that are regulated and have high trading volumes to minimize the risk of fraud or hacking.

It is also important to consider the exchange's fees, user interface, and customer support when choosing an exchange. Some popular cryptocurrency exchanges include Binance, Coinbase, Kraken, and Gemini.

#6. Watch Out for Scams

The cryptocurrency market is rife with scams and fraudulent projects that promise high returns or use aggressive marketing tactics. It is essential to be wary of these scams and look for warning signs such as promises of guaranteed returns or overly complex investment structures.

Always do your due diligence and research any project or investment opportunity thoroughly before investing. Look for red flags such as lack of transparency, absence of a whitepaper or roadmap, or a team with little to no experience in the cryptocurrency industry. This is an important step to understanding-the-risks-in-cryptocurrency.

#7. Stay Patient and Disciplined

Investing in cryptocurrency requires patience and discipline. The market is highly volatile, and prices can fluctuate rapidly, often without warning. It is essential to avoid making emotional decisions and instead stick to your investment strategy.

Set clear investment goals and timelines and regularly evaluate your portfolio to ensure it aligns with your objectives. Consider using tools such as stop-loss orders to automatically sell your cryptocurrency if the price drops below a certain level.

Investing in cryptocurrency can be a lucrative and exciting opportunity, but it also comes with high risks. By doing your research, diversifying your portfolio, investing only what you can afford to lose, using secure wallets and reputable exchanges, watching out for scams, and staying patient and disciplined, you can minimize your risk and increase your chances of success in the cryptocurrency market. Remember to always stay up-to-date on market news and developments, and be prepared to adapt your strategy as needed to stay ahead of the curve. This is an important step to understanding-the-risks-in-cryptocurrency.

V. Real-life examples of cryptocurrency investment risks:

- Mt. Gox Exchange Hack

In 2014, Mt. Gox, one of the largest Bitcoin exchanges at the time, suffered a massive hack that saw nearly 750,000 bitcoins stolen – worth over $20 billion at today's prices. It was a wake-up call for the crypto world, and a reminder that even the most secure systems can be vulnerable to attack.

- ICO Scams

Initial Coin Offerings (ICOs) have become a popular way for new cryptocurrency projects to raise funds. However, some ICOs have turned out to be scams, with the project creators disappearing with investors' money. In some cases, the scammers may have even fabricated the project entirely, with no intention of ever delivering a product or service.

One notable example of an ICO scam is the case of Pincoin and iFan, which defrauded investors out of $660 million in 2018. The project promised high returns and even created its own exchange, but ultimately vanished with investors' money.

Investors must be cautious when investing in ICOs, conduct thorough research on the project, and only invest what they can afford to lose to avoid falling victim to these scams.

- Pump and Dump Schemes

One of the most significant risks in cryptocurrency investment is the pump and dump scheme. In this scheme, investors artificially inflate the price of a low-value cryptocurrency by spreading false or exaggerated information about its potential, then quickly sell their holdings when the price reaches its peak, leaving unsuspecting investors with significant losses.

An infamous example of a pump and dump scheme is the case of BitConnect, a cryptocurrency that promised high returns but turned out to be a Ponzi scheme. The price of BitConnect rose dramatically in late 2017, but it ultimately collapsed in early 2018, resulting in losses of billions of dollars for investors. The fallout was catastrophic, with Bitconnect's price plummeting nearly 90% in a matter of days.

Other examples of cryptocurrency investment risks include hacks and security breaches, regulatory crackdowns, and market volatility. Investors must always be aware of these risks and take steps to minimize them to safeguard their investments.

Conclusion:

So, what's an investor to do? Should you avoid crypto altogether, or dive in headfirst and hope for the best? The answer, as with most things in life, lies somewhere in between. By conducting research, diversifying your investments, and staying vigilant against scams and fraud, you can help protect your investments and make informed decisions in the world of cryptocurrency. But for those who are willing to put in the effort, the rewards can be substantial. Just remember to keep your eyes open, your portfolio diversified, and your seatbelt fastened – it's going to be a wild ride. This is an important step to understanding-the-risks-in-cryptocurrency.

Disclaimer :