Did You Know The Rule of 72?

Many inexperienced investors wonder how long it will take for an investment to double. This can be calculated using The Rule of 72, a simple method for determining the time it will take for an investment to double based on a fixed annual interest rate. By dividing 72 by the rate of return, an investor can estimate how many years it will take for the initial investment to double.

Let us understand with an example: suppose a person is investing Rs 3,00,000 at the rate of 8%.

So 72/8 = 9, i.e., it will take 9 years for him to double the capital.

The Rule of 72 is a simple and useful formula used to estimate the time it takes for an investment to double in value, given a fixed annual rate of return. It’s a quick mental calculation that can provide a rough approximation without needing complex calculations or a financial calculator.

Here's how it works:

Divide 72 by the annual rate of return: Start by taking the number 72 and dividing it by the annual interest rate or growth rate of the investment. The result will be an approximation of the number of years it will take for the investment to double.

For example, if you have an investment with a 6% annual return: 72 ÷ 6 = 12

This means it would take approximately 12 years for your investment to double at a 6% annual return.

Estimate the time to double:

The result of the division gives you an estimate of the number of years it will take for your investment to double in value, assuming the rate of return remains constant.

Limitations:

The Rule of 72 provides a close approximation but may not be entirely accurate, especially for higher or variable interest rates. It’s most accurate for interest rates between 6% and 10%.

Applicability:

The Rule of 72 is often used for investments like savings accounts, bonds, or other fixed-income investments. It’s less applicable to investments with variable or uncertain returns, such as stocks.

Example:

Let’s say you have an investment with an annual return of 8%. Using the Rule of 72:

72 ÷ 8 = 9

It would take approximately 9 years for your investment to double at an 8% annual return.

The Rule of 72 is handy for quick estimations and for understanding the power of compound interest, but it’s important to remember that it’s just an approximation and may not accurately reflect the actual time it takes for an investment to double in value under certain circumstances.

Concept:

Let’s delve a bit deeper into the concept and the reasoning behind the Rule of 72.

1. Understanding Compound Interest:

Compound interest is the concept where the interest earned on an investment or deposit is added to the principal amount, and future interest is then calculated based on the updated principal. This results in exponential growth over time, as both the original amount and the accumulated interest continue to earn interest.

2. Approximating Doubling Time:

The Rule of 72 provides a quick way to estimate the time it takes for an investment to double in value under compound interest. By dividing 72 by the annual rate of return (or interest rate), you get an approximation of the number of years it will take for the investment to double.

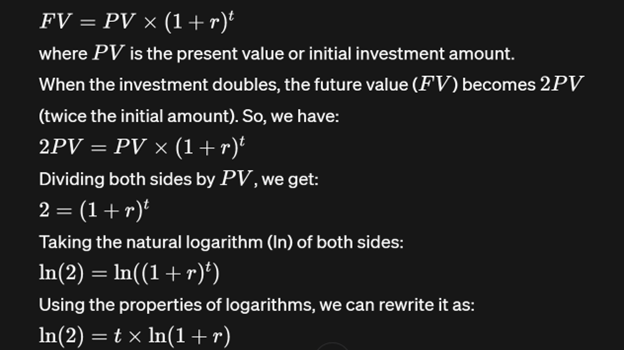

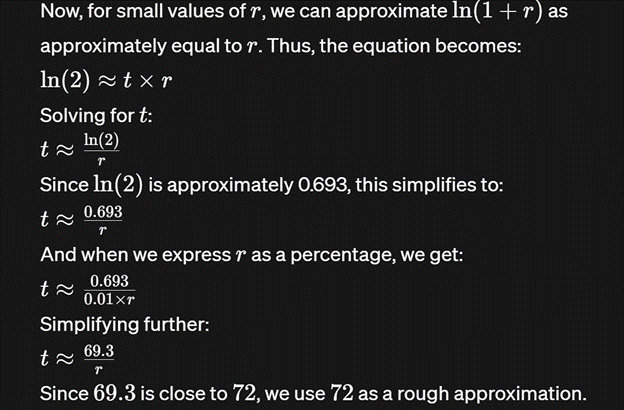

3. Derivation of the Rule:

The Rule of 72 is derived from the formula for compound interest. If we denote the time it takes for an investment to double as t (in years) and the annual rate of return as r (in percentage), we can express the future value (FV) of the investment as:

4. Limitations and Accuracy:

It’s important to note that the Rule of 72 is an approximation and may not be perfectly accurate, especially for higher interest rates or when compounding occurs more frequently than annually. Additionally, it assumes a constant rate of return, which may not always hold true in real-world scenarios.

5. Applications:

Despite its limitations, the Rule of 72 is widely used for its simplicity and usefulness in quickly estimating the effects of compound interest. It’s commonly used by investors, financial advisors, and individuals planning for retirement or long-term savings goals.