Unlocking Financial Stability by SWP 2025

Mastering Systematic Withdrawal Plans (SWP) in India: Your Path to Financial Stability

In this blog post, I’ll discuss “Unlocking Financial Stability by SWP 2025”, how they work, and the benefits of investing in them.

In the realm of personal finance, one often seeks avenues that promise stability and growth. Amidst the myriad of investment options, a Systematic Withdrawal Plan (SWP) emerges as a beacon of financial prudence, particularly in the Indian context. In this comprehensive guide, we delve into the intricacies of SWP, unravel its benefits, and elucidate its relevance in the Indian investment landscape.

Understanding Systematic Withdrawal Plan (SWP)

At its core, an SWP is an investment strategy offered by mutual funds that allows investors to withdraw a predetermined sum regularly from their investments. Unlike a lump sum withdrawal, SWP ensures a systematic and structured approach, akin to receiving a regular income stream. The periodic intervals could be monthly, quarterly, half-yearly or annually, as per the investor’s requirement. With every withdrawal, the value of your investment in the fund is reduced by the market value of the units you have withdrawn as the withdrawal happens at that day’s NAV (Net Asset Value). It is a right step in Unlocking Financial Stability by SWP 2025.

How does SWP work?

The mechanics of SWP are fairly straightforward. Investors allocate a certain amount in a mutual fund scheme and specify the frequency and amount they wish to withdraw. The fund house then disburses the specified sum by redeeming units from the investor’s holdings.

Let us understand this with the help of an example. Suppose Mr. Kumar purchased 10,000 units of a mutual fund scheme for Rs. 10 lakhs in January 2014. And, withdrew Rs. 10,000 per month for 4 months starting February 2014 via a systematic withdrawal plan.

Month | Cashflows | NAV | No. of units redeemed | Fund Units | Investment Value |

January | Rs.10,00,000 | 100 | 0 | 10,000 | Rs.10,00,000 |

February | -1,00,000 | 103 | 97 | 9,030 | Rs. 9,30,090 |

March | -1,00,000 | 102 | 98 | 8,050 | Rs. 8,21,100 |

April | -1,00,000 | 105 | 95 | 7,100 | Rs. 7,45,500 |

May | -1,00,000 | 106 | 94 | 6,160 | Rs. 6,52,960 |

So, by the end of May, Mr. Kumar has withdrawn Rs. 4,00,000 total via SWP and owns an investment worth Rs. 6,52,960.

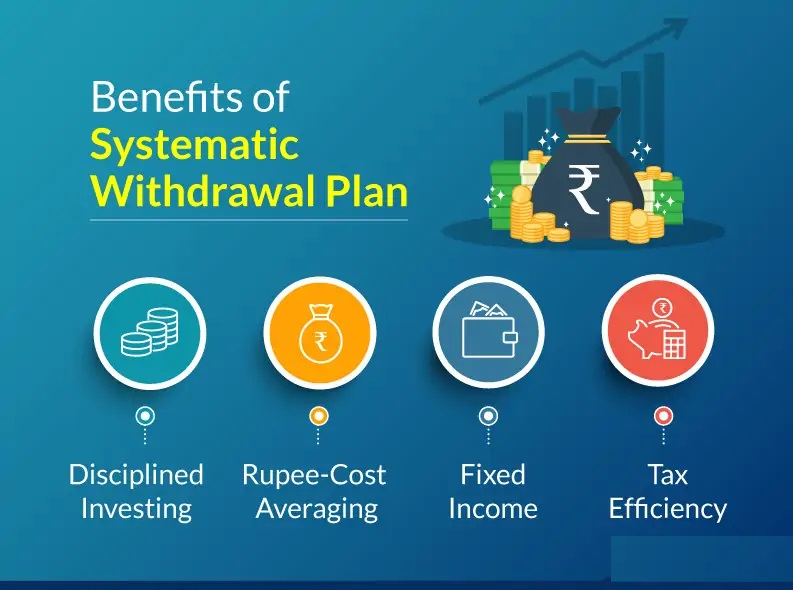

Benefits of SWP:

1. Financial Discipline:

SWP instils a sense of discipline in financial planning by ensuring regular withdrawals, akin to a salary or pension. An SWP automatically redeems some mutual fund units every month to meet your monthly expenses, regardless of market levels. It thus, protects you from withdrawing large amounts due to panic/fear during the times of market corrections. It also withdraws money even when markets are registering new highs and thus, protects you from the impulse to invest more money during boom periods. It is an important aspect in Unlocking Financial Stability by SWP 2025.

Example: Consider an investor, Mr. Sharma, who opts for an SWP to supplement his retirement income. By setting up a monthly withdrawal from his mutual fund investment, he ensures a steady stream of funds to meet his living expenses. This disciplined approach helps Mr. Sharma maintain financial stability throughout his retirement years, without the need to dip into his principal investment.

2. Risk Mitigation:

By opting for SWP, investors can mitigate the risk associated with market volatility. Since withdrawals are predetermined, investors are shielded from making impulsive decisions during market downturns. It is an important aspect in Unlocking Financial Stability by SWP 2025.

Example: During a market downturn, Mrs. Patel, an SWP investor, continues to receive her predetermined monthly withdrawals from her mutual fund investment. Despite the temporary decline in the market value of her investment, Mrs. Patel can navigate through the volatility without resorting to panic selling. This disciplined approach shields her from potential losses and allows her investment to recover when the market rebounds.

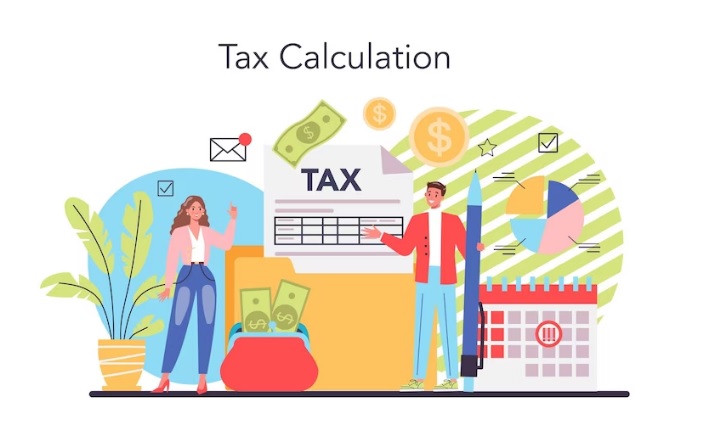

3. Tax Efficiency:

Each withdrawal made through an SWP is considered to be a combination of capital and income. Tax is only payable on the income component and not the capital component. For example, assume that Mr Rahul has invested Rs 10 lakh in a mutual fund and this grows to Rs 11 lakh (10% growth). He withdraws Rs 1 lakh from his mutual fund at the end of each year. Only 10% of his withdrawal (Rs 10,000) is considered as income and the balance (Rs 90,000) is considered as capital withdrawal. On the other hand, if he had invested in a bank FD and got Rs 1 lakh interest on a principal of Rs 10 lakh, the entire Rs 1 lakh would be considered as income and would be taxable. It is an important aspect in Unlocking Financial Stability by SWP 2025.

In India, SWP enjoys favourable tax treatment, especially in equity mutual funds held for over a year. Gains up to ₹1 lakh are exempt from taxation, thereby enhancing post-tax returns. A SWP can also prove to be more tax efficient because if it splits your income over several years.

4. Rupee Cost Averaging:

SWPs help investors benefit when they withdraw their investments due to rupee cost averaging. Rupee cost averaging gives an investor the average NAV of a mutual fund over several months/years rather than making him dependant on a NAV at a single point of time. SWP facilitates rupee cost averaging, wherein investors buy more units when prices are low and fewer units when prices are high. This averaging effect can potentially enhance long-term returns. It is an important aspect in Unlocking Financial Stability by SWP 2025.

Example: Ms. Rao invests ₹1 lakh in an equity mutual fund through an SWP with a monthly withdrawal of ₹5,000. In a month when the market experiences a downturn, Ms. Rao's ₹5,000 withdrawal buys more units at lower prices, effectively lowering her average cost per unit. Conversely, in a month of market upswing, the same withdrawal buys fewer units at higher prices. Over time, this rupee cost averaging strategy helps smooth out market fluctuations and potentially enhances Ms. Rao's investment returns.

5. Retirement Planning:

SWP serves as an ideal tool for retirement planning, offering a steady income stream post-retirement. A SWP helps an investor get a fixed periodic amount which can help him/her get a steady income in his/her retirement years or managing his/her child’s educational expenses. It is an important aspect in Unlocking Financial Stability by SWP 2025.

Example: Mr. and Mrs. Khanna, a retired couple, opt for an SWP to fund their post-retirement expenses. By setting up a monthly withdrawal from their mutual fund investment, they ensure a reliable source of income to maintain their desired standard of living during retirement. This structured withdrawal approach provides Mr. and Mrs. Khanna with financial security and peace of mind in their golden years.

Optimizing Your SWP Strategy:

SWP vs. Dividend Payout:

Understanding the nuances between SWP and dividend payout is crucial for investors. While SWP offers a structured withdrawal mechanism, dividend payout entails periodic distribution of profits by the fund. It is an important aspect in Unlocking Financial Stability by SWP 2025.

Example: Mr. and Mrs. Singh, both retirees, are considering options for generating regular income from their mutual fund investments. They analyse the differences between SWP and dividend payout. With SWP, they can specify the exact amount they wish to withdraw each month, providing them with predictable income to cover their expenses. On the other hand, dividend payout involves receiving periodic dividends from the fund, which may vary in amount and timing. After careful consideration, the Singhs opt for SWP as it offers greater control and consistency in their income stream.

SWP Taxation Rules in India:

Navigating the tax implications of SWP is imperative for maximizing returns. Delve into the tax treatment of SWP across various asset classes to optimize tax efficiency. It is an important aspect in Unlocking Financial Stability by SWP 2025.

Example: Ms. Sharma, a conservative investor, is planning to set up an SWP from her debt mutual fund investment to supplement her monthly income. She consults with her financial advisor to understand the tax implications. Since SWP from debt funds is subject to taxation as per the investor’s income tax slab, Ms. Sharma decides to structure her withdrawals strategically to minimize her tax liability. By spreading out her withdrawals over multiple financial years, she ensures that her total income remains within lower tax brackets, thereby optimizing her tax efficiency.

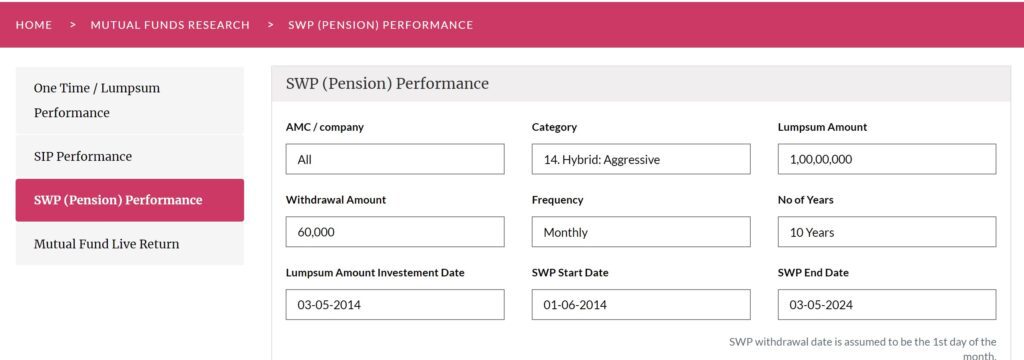

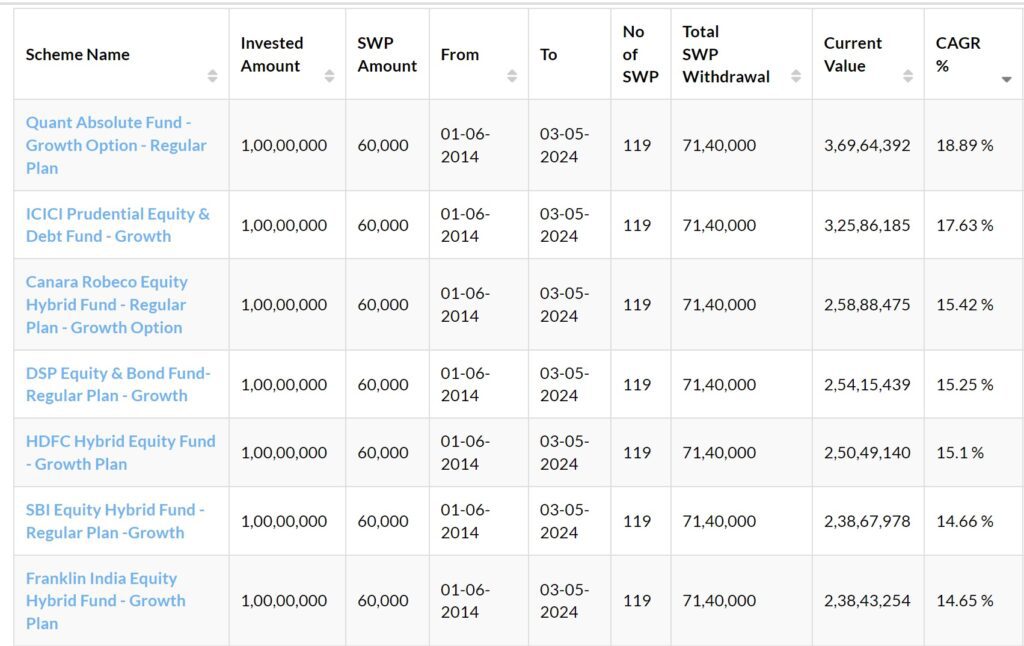

SWP Calculator:

Leveraging an SWP calculator can aid investors in determining the ideal withdrawal amount based on their financial goals, investment horizon, and risk tolerance. It is an important aspect in Unlocking Financial Stability by SWP 2025.

Example: Mr. Patel, a young investor, is planning for his future by investing in an equity mutual fund. He wants to determine the optimal withdrawal amount through SWP to achieve his financial goals while ensuring the longevity of his investment portfolio. Using an SWP calculator, Mr. Patel inputs his investment amount, expected returns, withdrawal frequency, and investment horizon. The calculator generates a customized withdrawal plan, helping Mr. Patel strike a balance between meeting his short-term financial needs and preserving his investment corpus for the long term.

Equity SWP:

Examine the nuances of SWP in equity mutual funds, including strategies for optimizing returns and managing volatility. It is an important aspect in Unlocking Financial Stability by SWP 2025.

Example: Mr. Rao, an experienced investor, is considering setting up an SWP from his equity mutual fund investment to generate regular income during his retirement years. Given the inherent volatility in equity markets, Mr. Rao adopts a cautious approach by selecting a balanced equity fund for his SWP. He opts for a conservative withdrawal rate to mitigate the impact of market fluctuations on his investment portfolio. By strategically rebalancing his portfolio and staying diversified, Mr. Rao aims to optimize his returns while minimizing downside risks associated with equity SWP.

Debt SWP:

Delve into the intricacies of SWP in debt funds, focusing on factors such as interest rate risk, credit risk, and liquidity. It is an important aspect in Unlocking Financial Stability by SWP 2025.

Example: Mrs. Gupta, a risk-averse investor, has allocated a portion of her savings to debt mutual funds to generate stable returns with lower volatility. She plans to set up an SWP from her debt fund investment to supplement her monthly income post-retirement. Before initiating the SWP, Mrs. Gupta thoroughly assesses the risk factors associated with debt funds, including interest rate risk and credit risk. She chooses a high-quality debt fund with a diversified portfolio of securities to minimize the risk of default. By conducting due diligence and staying informed about market conditions, Mrs. Gupta ensures the safety and reliability of her debt SWP strategy.

SWP in Retirement Planning:

Unravel the role of SWP as a cornerstone of retirement planning, ensuring financial security during the golden years. It is an important aspect in Unlocking Financial Stability by SWP 2025.

SWP Frequency:

Analyse the impact of SWP frequency on investment returns and cash flow management, weighing the trade-offs between monthly, quarterly, and annual withdrawals. It is an important aspect in Unlocking Financial Stability by SWP 2025.

SWP Withdrawal Strategies:

Explore advanced SWP withdrawal strategies, such as the constant rupee value, constant withdrawal percentage, and escalating withdrawal approaches. It is an important aspect in Unlocking Financial Stability by SWP 2025.

SWP in Market Downturns:

Develop a resilient SWP strategy to navigate market downturns, including techniques for rebalancing the portfolio and managing sequence of returns risk. It is an important aspect in Unlocking Financial Stability by SWP 2025.

Conclusion:

In the dynamic landscape of personal finance, embracing a systematic approach is paramount for achieving long-term financial stability. The Systematic Withdrawal Plan emerges as a potent tool, offering a structured mechanism to generate regular income while mitigating market risks. By optimizing your SWP strategy and leveraging the insights shared in this guide, you can embark on a journey towards financial freedom and prosperity. It is an important aspect in Unlocking Financial Stability by SWP 2025.