How Can Investing via SIPs Help You Generate Wealth in the Long Run?

Introduction:

In this blog post, I’ll explore how to generate wealth via SIP in the long run, with real-life examples and valuable insights.

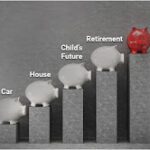

Investing is a powerful tool for building wealth and securing a financially stable future. Among various investment options available, Systematic Investment Plans (SIPs) have gained immense popularity due to their ability to generate consistent returns over the long term. SIPs offer a disciplined approach to investing by allowing individuals to invest small amounts at regular intervals.

Understanding SIPs and Their Benefits:

Systematic Investment Plans (SIPs) enable individuals to invest a fixed amount at regular intervals in mutual funds. This approach offers several benefits to generate wealth via SIP :-

(a) Rupee Cost Averaging:

SIPs follow a simple investment strategy of purchasing more units when the market is low and fewer units when the market is high. This strategy of rupee cost averaging helps investors lower the average purchase cost, thereby maximizing returns.

(b) Disciplined Approach:

SIPs instill financial discipline by encouraging regular investments. With a fixed amount deducted automatically from your bank account each month, you overcome the temptation of timing the market and avoid impulsive investment decisions.

(c) Power of Compounding:

By investing early and staying invested for the long term, SIP investors can leverage the power of compounding. The compounded growth significantly enhances the value of your investments over time.

SIPs vs. Lump Sum Investments:

A Comparative Analysis:

To understand the effectiveness of SIPs in wealth generation, let’s compare them with lump sum investments. Consider an example Meet Rahul and Neha, both looking to invest in a mutual fund with an expected average annual return of 10% over a fifteen-year period. Rahul decides to invest a lump sum amount of $100,000, while Neha chooses to invest $500 per month through SIPs.

Rahul’s lump sum investment of $100,000 grows over the fifteen-year period, considering the average annual return. After fifteen years, his investment would accumulate to approximately $404,556.

On the other hand, Neha starts her SIP investments by contributing $500 per month into the same mutual fund. Let’s break down Neha’s SIP investment over the fifteen-year period:

Year 1: Neha invests $500 per month, totaling $6,000 by the end of the year.

Year 2: Neha continues investing $500 per month, totaling $12,000 invested over two years.

Year 3: Neha maintains her monthly investments, totaling $18,000 invested over three years. And so on, until the fifteenth year.

As Neha consistently invests through SIPs, she benefits from rupee cost averaging, allowing her to buy more units when prices are low and fewer units when prices are high. This strategy helps lower her average purchase cost.

Additionally, Neha’s SIP investments benefit from the power of compounding. As her investments generate returns, these returns are reinvested, further boosting her overall investment growth.

After fifteen years of disciplined SIP investments, Neha’s accumulated investment value, considering the average annual return, would amount to approximately $192,651.

In this example, Neha’s SIP investment of $500 per month, when combined with rupee cost averaging and the power of compounding, results in a significant accumulated value over the fifteen-year period. While Rahul’s lump sum investment also generates returns, Neha’s consistent and disciplined approach allows her to achieve a comparable level of wealth accumulation.

This example illustrates the potential wealth-generating capability of SIPs. By investing small amounts regularly, investors can accumulate a significant corpus over time, outperforming lump sum investments in certain scenarios.

Case Studies of Successful SIP Investments:

Real-life case studies can provide valuable insights into the effectiveness of SIPs in generating wealth. Let’s explore two scenarios:

(a) Mr. Kapoor’s SIP Journey:

Mr. Kapoor, a salaried individual, started investing $1,000 per month in an equity-oriented mutual fund through SIPs at the age of 30. He continued investing for 30 years until his retirement at the age of 60. Despite market ups and downs, his disciplined approach allowed him to accumulate a substantial corpus of $1.2 million, thanks to the power of compounding.

(b) Ms. Sharma’s Goal-based SIPs:

Ms. Sharma, a young professional, had a goal of purchasing a house in ten years. She started investing $2,000 per month in a debt-oriented mutual fund through SIPs. With the disciplined savings habit and the power of compounding, she achieved her goal and was able to make a down payment for her dream home.

These case studies emphasize the importance of setting long-term investment goals, staying disciplined, and leveraging the power of compounding to generate wealth through SIP investments.

Tips for Maximizing SIP Returns:

While SIPs offer an excellent avenue for wealth generation, there are certain strategies that can help maximize your returns. Here are a few tips to consider:-

(a) Choose the Right Mutual Fund:

Selecting the appropriate mutual fund scheme based on your financial goals, risk tolerance, and investment horizon is crucial. Research and seek professional advice to identify funds with a consistent track record and experienced fund managers.

(b) Stay Consistent with Contributions:

Consistency is key when it comes to SIP investments. Stick to your investment plan and make regular contributions without succumbing to market volatility or timing the market. This approach ensures that you benefit from rupee cost averaging and the power of compounding.

(c) Review and Rebalance:

Periodically review your SIP investments to ensure they align with your financial goals. Rebalance your portfolio if required, based on changes in your risk appetite or market conditions. This step helps you stay on track and make adjustments when necessary.

(d) Take a Long-term Perspective:

SIPs are designed for the long run. Avoid getting swayed by short-term market fluctuations and maintain a long-term perspective. This approach allows you to stay invested during market downturns, capitalize on opportunities, and benefit from the compounding effect.

Conclusion:

Investing via Systematic Investment Plans (SIPs) provides an effective way to generate wealth in the long run. The disciplined approach, coupled with the benefits of rupee cost averaging and compounding, helps investors accumulate a significant corpus over time. By investing small amounts regularly, investors can mitigate the risks associated with market volatility and take advantage of market fluctuations.

Remember, investing is a personal journey, and it’s advisable to consult with a financial advisor to align your investment strategy with your financial goals and risk appetite. With careful planning and consistent efforts, SIPs can be a valuable tool to help you achieve your financial aspirations in the long run.

Disclaimer : It is important to note that SIPs are subject to market risks, and past performance is not indicative of future returns. However, historical data and numerous success stories demonstrate the potential of SIPs in building wealth. By setting clear investment goals, staying disciplined, and taking a long-term view, individuals can harness the power of SIPs to secure their financial future.