Unlocking the Potential of Real Estate Investment (2024)

Introduction:

In this blog, I will take you through everything you need to know about Unlocking the Potential of Real Estate Investment through the Real Estate Investment Trusts (REITs) in India, including their benefits, challenges, regulations, and investment strategies.

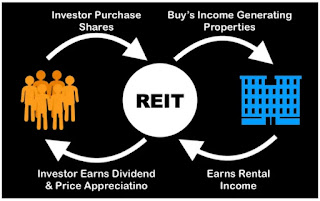

As an investor, it is essential to diversify your portfolio by considering different investment opportunities. The REITs have gained popularity in India over the past few years. REITs allow investors to own a part of a real estate portfolio without the hassle of managing properties themselves.

What are Real Estate Investment Trusts (REITs)?

REITs are investment vehicles that allow investors to invest in real estate assets without owning them physically. It is a type of mutual fund that invests in various types of real estate, such as residential, commercial, industrial, or retail properties and generates rental income or capital appreciation.

REITs can be publicly traded on stock exchanges or privately held, but most are publicly traded on major stock exchanges. This makes them a convenient way for investors to access the real estate market even with with a small amount of money, as they can buy and sell REIT shares just like they would with any other stock.

Understanding REITs in India - Definition, History, and Current Status

REITs were first introduced in India in 2007, but due to unfavorable market conditions, the first REIT was launched only in 2019. Real Estate Investment Trusts (REITs) were first introduced in India in 2007, but due to unfavourable market conditions, the first REIT was listed on the Indian stock market in 2019.

In India, REITs are regulated by the Securities and Exchange Board of India (SEBI). The Embassy Office Parks REIT, which owns and operates commercial office properties in India, was the first Indian REIT to be listed on the Bombay Stock Exchange and National Stock Exchange.

Since then, several other Indian REITs have been listed on the stock market, including Mindspace Business Parks REIT, Brookfield India Real Estate Trust, and Indiabulls Real Estate Investment Trust. These are the Real Estate Investment Trusts (REITs) in India for Unlocking the Potential of Real Estate Investment.

Benefits of investing in Indian REITs - High Returns, Low Risk, Diversification

#1. Access to Real Estate Investments:

REITs offer investors the opportunity to invest in real estate without the need to buy and manage properties themselves. This can be especially attractive for investors who don’t have the time, expertise, or capital to invest in real estate directly. These are the good instruments for Unlocking the Potential of Real Estate Investment.

#2. High Dividend Yields:

REITs are required by law to distribute at least 90% of their taxable income to shareholders as dividends. This can result in high dividend yields for investors, which can be especially attractive for income-seeking investors. These are the good instruments for Unlocking the Potential of Real Estate Investment.

#3. Diversification:

REITs typically invest in a portfolio of properties, which can provide diversification benefits for investors. This can help to reduce the risk of investing in a single property or market. These are the good instruments for Unlocking the Potential of Real Estate Investment.

#4. Liquidity:

REITs are publicly traded on major stock exchanges, which makes them a liquid investment. Investors can buy and sell REIT shares just like they would with any other stock. These are the good instruments for Unlocking the Potential of Real Estate Investment.

Challenges in the Indian REIT Market - Lack of Investor Awareness, Regulatory issues, Market volatility

#1. Lack of Investor Awareness :

The first challenge is the lack of investor awareness about REITs. Many investors are not aware of REITs and how they work.

#2. Regulatory Issues :

The second challenge is regulatory issues. The regulatory framework for REITs is still evolving, and there is a need for clarity on various issues.

#3. Market Risk:

REITs are subject to the same market risks as other stocks. This means that the value of their shares can fluctuate based on market conditions, such as changes in interest rates or economic downturns. Lastly, the Indian REIT market is volatile, and investors need to be cautious while investing.

#4. Interest Rate Risk:

REITs are often sensitive to changes in interest rates. When interest rates rise, the cost of borrowing for REITs increases, which can reduce their profitability.

#5. Management Risk:

The performance of a REIT is heavily dependent on the quality of its management team. Poor management decisions can lead to underperformance and lower returns for investors.

#6. Tax Implications:

REIT dividends are taxed differently than dividends from other stocks. While REIT dividends are generally taxed at a lower rate than ordinary income, they are still subject to certain tax rules and regulations.

#7. Lack of Depth:

The Indian REIT market is still in its early stages, and there are limited options available for investors to choose from.

Indian REIT Regulations - Framework, Compliance, Tax Structure

REITs in India are taxed as special purpose vehicles (SPVs) and are exempt from income tax. However, the dividends received by investors are taxed at their applicable tax rates. Additionally, REITs are required to deduct tax at source on the dividends paid to investors.

The Securities and Exchange Board of India (SEBI) regulates the Indian REIT market. SEBI has laid down strict guidelines and regulations for Indian REITs, which include:

#1. Minimum Asset Requirement:

Indian REITs must have a minimum of two income-generating properties, with at least 80% of the assets invested in income-generating real estate projects. Additionally, the regulations require REITs to have a minimum asset size of INR 500 crore and a minimum public float of 25%.

#2. Distribution of Income:

Indian REITs must distribute at least 90% of their income to investors as dividends.

#3. Listing Requirements:

Indian REITs must be listed on a recognized stock exchange, and at least 25% of the total units must be held by public shareholders.

Types of Indian REITs - Equity, Mortgage, Hybrid

#1. Equity REITs:

Equity REITs invest in income-generating properties, such as office buildings, shopping centers, and apartment complexes. They generate income by renting out these properties and distributing the rental income to shareholders as dividends. These are the good instruments for Unlocking the Potential of Real Estate Investment.

#2. Mortgage REITs:

Mortgage REITs invest in mortgages and mortgage-backed securities. They generate income by earning interest on the mortgages they hold or the securities they invest in. Mortgage REITs typically have higher dividend yields than equity REITs, but they are also more sensitive to changes in interest rates. These are the good instruments for Unlocking the Potential of Real Estate Investment.

#3. Hybrid REITs:

Hybrid REITs invest in both properties and mortgages. They generate income from both sources and can provide a balanced portfolio for investors. These are the good instruments for Unlocking the Potential of Real Estate Investment.

How to invest in Indian REITs - Eligibility Criteria, Process, Documentation

Investing in Indian REITs is similar to investing in any other shares through a broker or online trading platform. Some REITs may also offer direct investment options, which allow investors to buy shares directly from the company. Here are the steps to invest in Indian REITs:

1. Open a Brokerage Account:

To invest in Indian REITs, you need to open a demat account and a trading account with a SEBI-registered broker. Additionally, investors need to submit necessary documentation, such as KYC documents, PAN card and bank account details.

2. Research:

Conduct research on the different REITs available in the Indian market, their investment strategy, management team, and historical performance. This is essential step for Unlocking the Potential of Real Estate Investment.

3. Choose a REIT:

Select a REIT that fits your investment objectives and risk profile. This is essential step for Unlocking the Potential of Real Estate Investment.

4. Place an Order:

Place an order to buy REIT shares through your brokerage account.

5. Monitor Your Investment:

Monitor your investment regularly and make adjustments to your portfolio as necessary. When investing in REITs, it’s important to consider factors such as the quality of the management team, the types of properties or mortgages the REIT invests in, and the dividend yield. Investors should also be aware of the risks associated with investing in REITs, such as market risk, interest rate risk, and management risk. This is essential step for Unlocking the Potential of Real Estate Investment.

Indian Real Estate Market - Overview, Trends, Opportunities

The Indian real estate market is one of the fastest-growing markets in the world. The market is driven by factors such as urbanization, increasing disposable income, and government initiatives such as Smart Cities and Housing for All. The Indian real estate market offers several investment opportunities across commercial, residential, and retail segments. This is essential instrument for Unlocking the Potential of Real Estate Investment.

Indian Commercial Real Estate Market - Analysis, Growth potential, Risks

The Indian commercial real estate market is witnessing a surge in demand due to the growth of the IT/ITES sector, e-commerce, and the startup ecosystem. The market is expected to grow at a CAGR of 9.2% between 2021 and 2026. The risks associated with investing in the commercial real estate market include market volatility, lack of transparency, and regulatory challenges. This is essential instrument for Unlocking the Potential of Real Estate Investment.

Indian Residential Real Estate Market - Analysis, Growth potential, Risks

The Indian residential real estate market is witnessing a recovery after a period of slowdown. The market is driven by factors such as increasing urbanization, nuclear families, and the government’s focus on affordable housing. The market is expected to grow at a CAGR of 11% between 2021 and 2026. The risks associated with investing in the residential real estate market include market volatility, delays in project completion, and regulatory challenges. This is essential instrument for Unlocking the Potential of Real Estate Investment.

Conclusion :

Indian REITs offer a lucrative investment opportunity for investors looking to diversify their portfolio. While the Indian REIT market has several benefits, such as high returns and low risk, it also comes with several challenges, such as lack of investor awareness and regulatory issues. However, proper investment strategies, portfolio diversification, and risk management are essential steps for Unlocking the Potential of Real Estate Investment to reap the benefits of investing in the Indian real estate market.

Call to Action:

If you’re interested in investing in Indian REITs, make sure you do your research and consult with a financial advisor. Investing in REITs can be a great way to generate stable returns and diversify your portfolio, but it’s important to understand the risks and challenges associated with this investment option. With the Indian real estate market expected to continue growing in the coming years, investing in REITs can be a smart investment choice for long-term investors with a sound investment strategy.