What is an Index Fund and How does it work? (2023)

Introduction:

In this blog post, I'll dive into What is an Index Fund and How does it work ? I would also explore why they're worth considering as a part of your investment portfolio.

Are you tired of hearing about complicated investment strategies that only the top 1% can understand? Well, fear not my friend because index funds are here to save the day! Index funds have been creating quite a buzz in India's financial sector. This type of mutual fund is designed to track a specific market index and has been gaining popularity among investors looking for a low-cost and transparent investment option.

Background

John Jack Bogle, in 1976, introduced Index Funds to the retail investors. The fund was called Vanguard 500 Index Fund which tracked the S&P 500 Index. The objective was to achieve broad diversification without having to spend a lot on buying individual securities or paying the high fees associated with actively managed mutual funds. Nevertheless, Index Funds have evolved in many ways since 1976. And investors can now use Index Funds to gain additional exposure to certain asset classes, markets, sectors, or even investment styles.

What is an Index Fund?

Now, you may be wondering what an index even is. An index is a collection of stocks that are used as a benchmark to measure the performance of a particular market or sector.

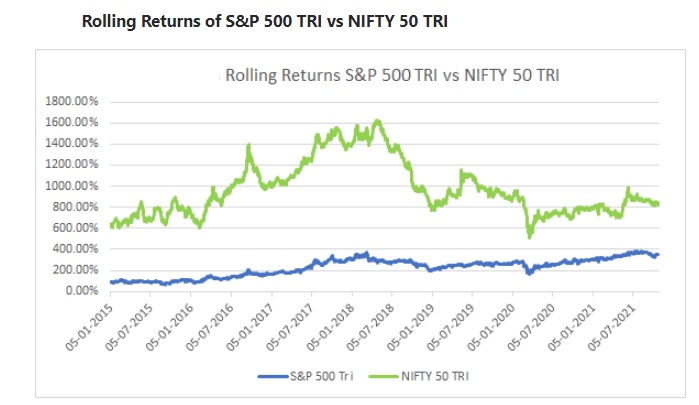

Index funds in India either track the Sensex or the Nifty 50. Both indexes are widely used as benchmarks for the Indian stock market, with the Sensex representing 30 of the largest and most actively traded stocks, and the Nifty 50 representing the top 50 companies listed on the National Stock Exchange of India.

Simply put, an index fund is a type of mutual fund that tracks a specific stock market index, such as the S&P 500 or the NIFTY 50 in India. An index fund invests in the same stocks as the index it tracks, and in the same proportion. For example, if the Sensex contains 30 stocks and a particular stock represents 5% of the index, then the index fund will invest 5% of its assets in that stock. The goal of an index fund is to replicate the performance of the index it's tracking. So, if the NIFTY 50 goes up by 10%, the index fund should also go up by 10%.

A mutual fund is a pool of money from multiple investors that is invested in various assets, such as stocks or bonds. So, an index fund is a specific type of mutual fund that is designed to mimic the performance of a particular index.

How do Index Funds Work in India?

In India, index funds work in the same way as they do in other parts of the world. There are a few different types of index funds available, including those that track the NIFTY 50, NIFTY Next 50, BSE Sensex, and other indices.

Investing in an index fund is relatively straightforward. Index funds can be purchased directly from mutual fund companies or through online investment platforms. First, you need to open an account with a brokerage or a mutual fund company. Then, you can choose the index fund you want to invest in and purchase shares of the fund.

Index funds in India are typically passively managed, which means that the fund's manager is not actively making decisions about which stocks to buy or sell. Instead, they simply track the performance of the index and adjust the fund's holdings accordingly. This approach keeps costs low, which means that investors can enjoy higher returns without having to pay high management fees.

Why Invest in an Index Fund?

Now that you know what an index fund is and how it works, you may be wondering why you should invest in one.

Here are a few reasons:

1. Low Cost

Since index funds are passively managed, they require less research and analysis than actively managed funds. This means that the fees associated with them are typically lower, making them an attractive option for investors who are looking to minimize their expenses.

2. Simplicity

Another advantage of index funds is their simplicity. With an index fund, you don't need to worry about analyzing individual stocks or timing the market. Instead, you can simply invest in the fund and let it do the work for you. This approach not only saves time but also reduces the stress of investing.

3. Diversification

The main advantage of an index fund is that it allows investors to get exposure to a diversified portfolio of stocks without having to pick individual stocks themselves. This means that investors can spread out their risk across a range of stocks and industries, which can help to minimize the impact of any one stock or sector performing poorly. This can help reduce the risk of your portfolio and provide a more stable investment.

4. Transparency

Index funds are transparent, meaning that investors can easily see which stocks are held in the fund and in what proportion. This makes it easier for investors to understand where their money is being invested.

5. Long-Term Growth

Now that you know what an index fund is and how it works, you may be wondering why you should invest in one.

Types of Index Funds

1. Market Capitalization Index Funds:

These funds invest in a broad range of stocks listed on the major Indian stock exchanges based on their market capitalization, such as the BSE Sensex or the Nifty 50. These funds provide investors with a low-cost way to gain exposure to a diversified portfolio of stocks that represent a specific market segment and have historically performed well over the long term.

2. Equal Weight Index Funds:

Equal weight index funds are a type of index fund that invests in a broad range of stocks based on equal weightage, rather than market capitalization. These funds provide investors with exposure to a diversified portfolio of stocks across different sectors and have the potential to outperform market cap-weighted index funds in certain market conditions.

3. Factor-Based or Smart Beta Index Funds:

Factor-based or smart beta index funds are a type of index fund that uses a rules-based approach to select and weight stocks based on certain factors such as value, momentum, and quality. These funds aim to outperform traditional market cap-weighted index funds by providing exposure to stocks that exhibit certain characteristics associated with higher returns.

4. Sector-Based Index Funds:

Sector-based index funds in India are a type of index fund that invests in a specific sector of the stock market, such as technology, healthcare, or energy. These funds provide investors with exposure to a concentrated portfolio of stocks within a particular industry or sector, which can offer higher potential returns but also carry higher risk.

5. Broad Market Index Funds:

Broad market index funds are a type of index fund that invests in a wide range of stocks, typically representing the entire stock market or a large segment of it. These funds provide investors with a diversified portfolio of stocks, reducing the overall risk of investing in individual stocks, and have low management fees.

6. Debt Index Funds:

Debt index funds in India are a type of index fund that invests in fixed-income securities such as government bonds, corporate bonds, and money market instruments. These funds provide investors with exposure to a diversified portfolio of debt instruments, typically with lower risk and lower returns compared to equity-based index funds.

7. Custom Index Funds:

Custom index funds are a type of index fund that can be tailored to the specific needs and preferences of individual investors or institutions. These funds allow investors to select specific stocks or sectors to include in the index, or to exclude certain stocks or sectors from the index, providing greater flexibility and control over their investment portfolio.

8. Strategy Index Fund:

Strategy index funds in India are a type of index fund that uses a specific investment strategy, such as low volatility, high dividend yield, or growth-oriented, to select and weight stocks in the index. These funds aim to outperform traditional market cap-weighted index funds by following a specific strategy that has historically provided higher returns.

9. International Index Funds:

International index funds in India are a type of index fund that invests in a diversified portfolio of stocks listed on international stock exchanges. These funds provide Indian investors with exposure to global markets and enable them to diversify their investment portfolio geographically. However, they may carry additional currency risk and require higher fees.

The Future of Index Funds in India

As the Indian economy continues to grow, index funds are likely to become an increasingly popular investment option for Indian investors. According to a report by CRISIL, the Indian mutual fund industry is expected to grow at a compound annual growth rate of 17% over the next five years, driven in part by the growth of index funds.

In addition, the Securities and Exchange Board of India (SEBI) has taken steps to encourage the growth of index funds in the country. In 2017, SEBI announced that mutual funds could offer passive schemes tracking a custom index, in addition to the Sensex and Nifty 50. This move was designed to encourage the development of a broader range of index funds, which would give investors more options for diversifying their portfolios.

Another factor that is likely to drive the growth of index funds in India is the increasing awareness among investors about the benefits of passive investing. As more investors become aware of the advantages of investing in low-cost index funds, they are likely to shift their investments away from actively managed funds.

Overall, the future of index funds in India looks bright. As more investors become aware of the benefits of passive investing and the low costs associated with index funds, these funds are likely to see increased inflows. This, in turn, will drive down fees and make index funds even more accessible to a wider range of investors.

However, it's important to note that while index funds can be a great investment option, they may not be suitable for all investors. For example, if you are looking for high returns and are willing to take on more risk, an actively managed fund may be a better option for you.

Index Funds in India:

Here are 10 good index funds in India, based on their historical performance and popularity:

1. Nippon India Index Fund - Sensex Plan

2. UTI Nifty Index Fund

3. ICICI Prudential Nifty Index Fund

4. HDFC Index Fund - Nifty 50 Plan

5. SBI Nifty Index Fund

6. Franklin India Index Fund - NSE Nifty Plan

7. Kotak Nifty ETF

8. DSP Nifty 50 Index Fund

9. IDBI Nifty Index Fund

10. Aditya Birla Sun Life Nifty ETF

Conclusion:

In conclusion, index funds are a simple and effective investment option that can provide investors with exposure to a wide range of stocks while keeping costs low. In India, the popularity of index funds is on the rise, driven by factors such as increasing awareness among investors and new SEBI regulations requiring mutual funds to offer at least one passive fund.

Whether you're a seasoned investor or just getting started, index funds are definitely worth considering. So, the next time you're thinking about investing your hard-earned money, give index funds a try and see how they can help you achieve your financial goals.